For a variety of reasons, second and third marriages with are becoming more prevalent in our society. As you and your future spouse consider merging your lives together, take into account that blended family issues can complicate your life and your financial...

FINANCE

So, you want to buy a Bimmer?

"Drive for show, putt for dough" is not only a great axiom for playing golf, it can also be applied to your investment strategy. Investment strategies should be developed after a thorough understanding of your "risk tolerance". Risk tolerance is the ability to accept...

Tax Cuts and Jobs Act

On December 20, 2017, the U. S. House and Senate passed the Tax Cuts and Jobs Act (TCJA). This is the largest major tax reform in over three decades and contains a whole host of tax provisions that impact individuals and businesses. With a few rare exceptions, the...

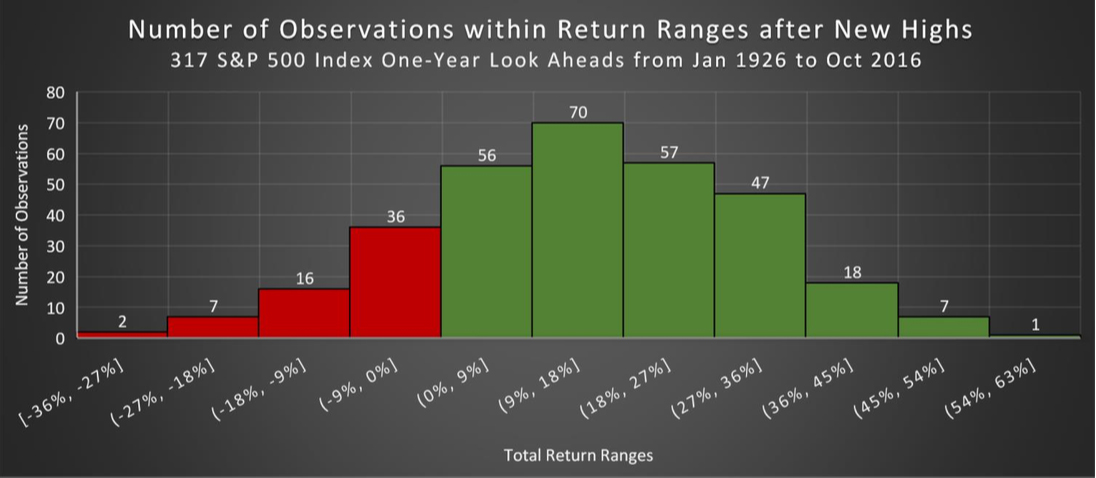

What should you do about market highs?

Global stock markets have performed strongly during 2017, pushing many broad market US and international indices to new highs. While investors welcome the performance, many also question whether they should reduce their exposure to stocks. The answer typically depends...

Alternative Investments

Investors, both institutional and retail, often invest in alternatives in pursuit of greater diversification or risk reduction; however, alternatives might fail to reliably accomplish these goals. Portfolio Construction Typically within a diversified portfolio, stocks...

Credit Rating

You may have noticed that over the past few years television and radio ads increasingly involve discussions about credit monitoring services. In light of some recent data breaches, and as we pass the halfway point of the year, it might be a good time to take some...

Maximize Your Deductions

Everyone likes to save on taxes. Making the most of deductions is one avenue available to taxpayers to reduce their tax bill. All taxpayers have the option to either itemize deductions or take the standard deduction, which is currently $12,700 for a married couple...